Asset Allocation and REITs

Diversification with REITs

REITs traditionally are thought of as a good investment for diversifying assets. Modern portfolio theory advocates diversification to minimize overall risk. In other words, investors should allocate their portfolios among a variety of investments in order to weather different market conditions. It is believed that such a diversified portfolio may limit overall portfolio volatility or risk.

Traditional Asset Classes Used for Diversification

For illustration only. This is not a recommendation of how to allocate a portfolio.

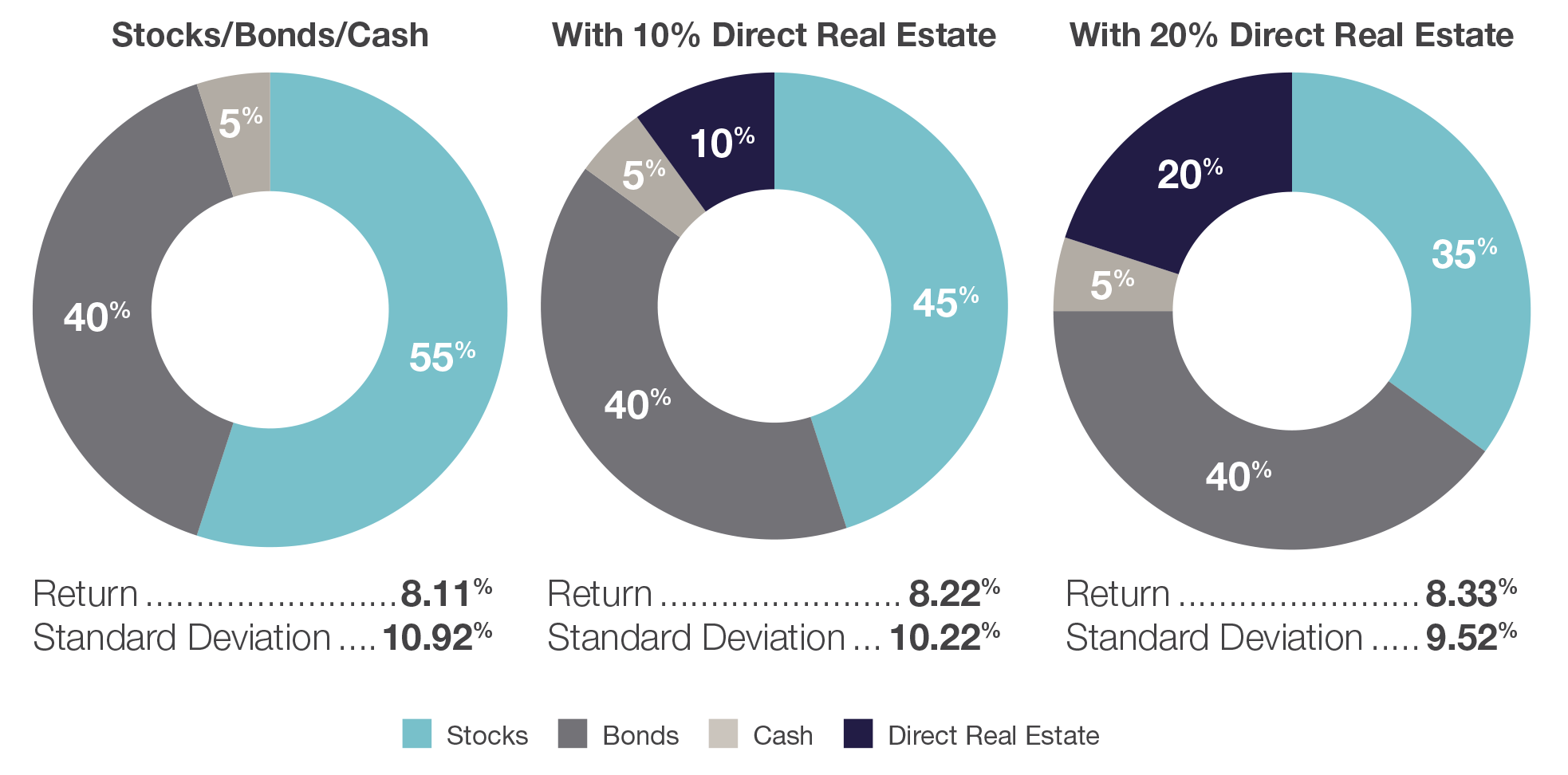

Real Estate Has the Potential to Reduce Standard Deviation and Increase Return

2006 to 2016 (10 Years)

Investing 10 or 20 percent in direct real estate both increased the portfolio’s total return and lowered the portfolio’s overall standard deviation.

The charts above compare the returns of the S&P 500 Index, Barclays U.S. Aggregate Bond Index and the NCREIF (National Council of Real Estate Investment Fiduciaries) Index, with and without an asset allocation to direct real estate, over a 10-year time period. An investment in NCREIF is not the same as an investment in a nonlisted REIT. These charts also reflect the standard deviation for each allocation example. Standard deviation is a measurement of the variability of an investment, derived from its historical returns. A higher standard deviation indicates a greater variability of an investment. The S&P 500 Index is a market capitalization weighted index of 500 widely held equity securities, designed to measure broad U.S. equity performance. The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The Index includes Treasuries, government-related and corporate securities, mortgage backed securities, adjustable rate mortgage pass-through asset backed securities, and commercial mortgage backed securities. NCREIF Property Index (NPI) is the accepted index created to provide an instrument to gauge the investment performance of the commercial real estate market. Originally developed in 1982, the unleveraged index is made up of more than 7,353 properties, worth a total of about $505 billion (as of Q2 2016) from all the U.S. regions and real estate land uses. NPI is an index that reflects the returns of a large pool of individual commercial real estate properties, is leverage free with no fees and includes a blended pool of institutional quality properties.

Shares of a nonlisted REIT have limited liquidity. An investment in a listed company is liquid, as shares can be bought or sold on an exchange at any time. Investing in shares of a nonlisted REIT also differs from investing directly in real estate, as represented by the NPI, including the expenses related to a nonlisted REIT offering and other fees and expenses that the issuer may pay.

Past performance is no guarantee of future results. These charts are for illustrative purposes only. Each index provides a broad representation of a particular asset class and is not indicative of any investment. Asset allocation does not ensure a profit or protect against a loss. The rates of returns shown do not reflect the deduction of fees and expenses inherent in investing. An investment cannot be made directly in an index.