The spread of smartphones and access to online information hasn’t changed the way people shop. Digital retailing is capturing headlines and inspiring spirited debate as retailers plan how to best invest for future success.

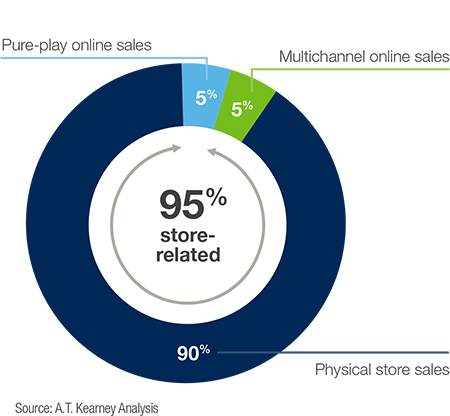

But, beyond the headlines, physical stores remain the foundation of retailing, evidenced by the fact that 90 percent of all retail sales are transacted in stores and 95 percent of all retail sales are captured by retailers with a brick-and-mortar presence.2

Shoppers actually find physical stores appealing – they provide consumers with a sensory experience that allows them to touch and feel products, immerse in brand experiences, and engage with sales associates who provide tips and reaffirm shopper enthusiasm for their new purchases.

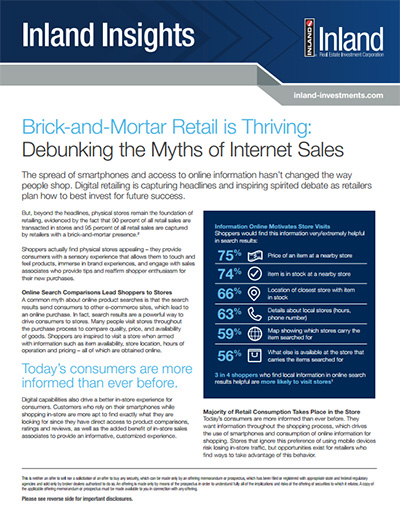

Online Search Comparisons Lead Shoppers to Stores

A common myth about online product searches is that the search results send consumers to other e-commerce sites, which lead to an online purchase. In fact, search results are a powerful way to drive consumers to stores. Many people visit stores throughout the purchase process to compare quality, price, and availability of goods. Shoppers are inspired to visit a store when armed with information such as item availability, store location, hours of operation and pricing – all of which are obtained online.

Today’s consumers are more informed than ever before.

Digital capabilities also drive a better in-store experience for consumers. Customers who rely on their smartphones while shopping in-store are more apt to find exactly what they are looking for since they have direct access to product comparisons, ratings and reviews, as well as the added benefit of in-store sales associates to provide an informative, customized experience.

Majority of Retail Consumption Takes Place in the Store

Today’s consumers are more informed than ever before. They want information throughout the shopping process, which drives the use of smartphones and consumption of online information for shopping. Stores that ignore this preference of using mobile devices risk losing in-store traffic, but opportunities exist for retailers who find ways to take advantage of this behavior.

Stores can gain an advantage by having optimum search engine results and a mobile friendly website or app, which allows them to create experiences tailored just for in-store shoppers. For example, they can offer personalized coupons and exclusive offers, promotions for related items, as well as alternative fulfillment options, such as free home delivery for large or out-of-stock merchandise. Stores that elevate their online presence can engage consumers while they’re in the store – a captive audience with time invested and dollars ready to spend.

Total U.S. Retail Sales (2013)2

Millennials Prefer Shopping in Stores

According to an Opinion Lab study, digitally-savvy Millennials actually prefer stores over shopping carts, despite their penchant for technology.

The survey, which polled 1,103 consumers in April, found that 37 percent of Millennials – defined as adults between ages 15 and 35 – would rather shop in stores, while only 27 percent would rather shop online.3

The results are further evidence that, brick-and-mortar stores – where the majority of transactions are made – are still relevant among shoppers.

Shoppers Want to See, Touch and Try Before they Buy

Although experts often say the store’s biggest edge over online shopping is the ability for customers to see and try on products, 93 percent of Millennials – who have a reputation for being pricefocused, savvy shoppers – said the most important factor to them when shopping at a retail store is good value and deals.3

The ability to touch and feel merchandise ranked second, with 61 percent of Millennials saying this was important.3 In addition, the physical store is where they can bring their friends and receive inperson feedback prior to a purchase.

The Opinion Lab report also found that overall, shoppers said they prefer retailers who operate both a physical store and a website to those who only have an online shop – a preference that is shared by Millennials and non-Millennials alike.3

The shopping experience is becoming increasingly mobile. Retailers that provide relevant, local information online will increase both reach and engagement, and help drive shoppers to stores. Digital capabilities have fundamentally reshaped the shopping journey, but 95% of all retail sales were captured by retailers with a brick-andmortar presence.2

Sources:

- 1 thinkwithgoogle.com – Three Digital to In-Store Shopping Myths Debunked.

- 2 AT Kearney Analytics – On Solid Ground: Brick-and-Mortar is the Foundation of Omnichannel Retailing, 2014.

- 3 CNBC – Millennials Don’t Want to Shop Where You May Think – Krystina Gustafson, May 28, 2014.

Disclosure

The views expressed herein are subject to change based upon economic, real estate and other market conditions. These views should not be relied upon for investment advice. Any forwardlooking statements are based on information currently available to us and are subject to a number of known and unknown risks, uncertainties and factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

Important Risk Factors to Consider

Some of the risks related to investing in commercial real estate include, but are not limited to: market risks such as local property supply and demand conditions; tenants’ inability to pay rent; tenant turnover; inflation and other increases in operating costs; adverse changes in laws and regulations; relative illiquidity of real estate investments; changing market demographics; acts of God such as earthquakes, floods or other uninsured losses; interest rate fluctuations; and availability of financing. Some of the risks specifically related to investing in a non-traded real estate investment trust (or “REIT”) include, but are not limited to:

- The board of directors, rather than the trading market, determines the offering price of shares; there is limited liquidity because shares are not bought and sold on an exchange; repurchase programs may be modified or terminated; a typical time horizon for an exit strategy may be longer than five years; and there is no guarantee that a liquidity event will occur.

- Distributions cannot be guaranteed and may be paid from sources other than cash flow from operations, including borrowings and net offering proceeds. Payments of distributions from sources other than cash flow from operations may reduce the amount of capital a REIT ultimately invests in real estate assets and a stockholder’s overall return may be reduced.

- Failure to qualify as a REIT and thus being required to pay federal, state and local taxes, which may reduce the amount of cash available for distributions.

- Principal and interest payments on borrowings will reduce the funds available for other purposes, including distributions to stockholders. In addition, rates on loans can adjust to higher levels, and there is a potential for default on loans.

- Conflicts of interest with, and payments of significant fees to, a business manager, real estate manager or other affiliates.

- Tax implications are different for each stockholder. Stockholders should consult a tax advisor.

Publication Date: 05.23.2016