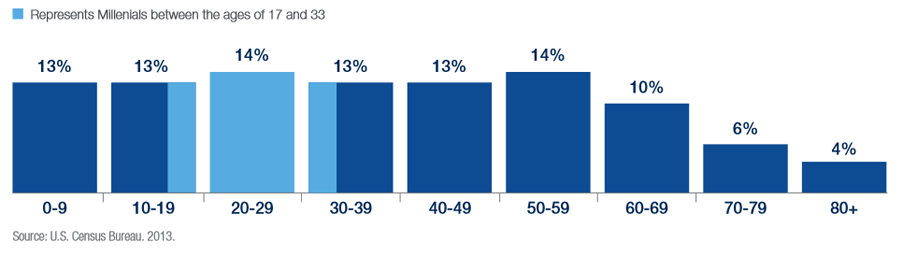

Millennials, born between 1980 and 1996, are the largest generation in the United States, representing approximately one-quarter of the total population. With the first of this generation in their early thirties, most Millennials are at the beginning of their careers and will be an important engine of housing and the overall economy for decades to come.

Millennials formed millions of independent households over the past five years, according to the Joint Center for Housing Studies at Harvard University. Because this generation is so large, the total number of households headed by 20-somethings is actually higher than a decade ago. Meanwhile, with Millennials aging and the percent of 30-34 year-olds that head households being higher than that of 20-24 year-olds, the number of households is expected to be lifted significantly over the coming decade.1

When it comes to housing trends, many characteristics of Millennials help explain why they prefer to rent versus buy.

They’re Underemployed

Millennials make up approximately 25 percent of the U.S. workforce.2 But millions of Millennials are unemployed and a large percentage of employed Millennials are underemployed, a condition defined as working in jobs that typically do not require a bachelor’s degree. College graduates’ unemployment and underemployment rates are the highest in 20-plus years.3 An analysis by the Federal Reserve Bank of New York looked at employment trends for college graduates with at least a bachelor’s degree. The NY Fed found that in 2012 about 44 percent of graduates were working in jobs that didn’t require a college degree, and only 36 percent of underemployed college graduates were in what the researchers called “good non-college jobs” — those paying around $45,000 a year — down from around half of underemployed college graduates in the 1990s.4

Education, employment, debt and cash management all tie together. Millennials have the highest student loan debts of any generation and problems finding full-time employment, making it difficult to save for a down payment on a starter home.

U.S. Population (316,128,839) by Age Range

They’re Diverse

Millennials are more racially and ethnically diverse than any previous generation. And the growth in diversity will only accelerate as they start their families. The Hispanic population is expected to grow by 167 percent by 2050 with Asians following closely behind at 142 percent growth by 2050.5 Seventy-one percent of Millennials appreciate the influence of other cultures on the American way of life, compared with 62 percent of Boomers.5

A diverse Millennial population is drawn to a community and shared spaces often found in apartment buildings. They enjoy common areas such as coffee bars, libraries and recreation rooms.

The Millennial generation now represents 83.1 million people.6

They Prize Quality of Life

Unlike past generations that worked well beyond a 40-hour work week, Millennials are not convinced that such sacrifices are worth the potential rewards. A balance between their personal and work lives is most important to them. A study by PwC found that 95 percent of respondents say that work/life balance is important to them and 70 percent say it’s very important.2

Seventy-nine percent of Millennials agree that “It is more important to enjoy my job than to make a lot of money,” and 86 percent agree that “It is important to me to have a career that does some good in the world.” Also, most Millennials place a high value on having a happy family life and are willing to make personal sacrifices in order to achieve it. Sixty percent expect that they will give up some career goals in order to have the personal life they want.7

Millennials may tend to shy away from homeownership because of their propensity to prize quality of life over money. A lot of work goes into maintaining a home—yard work, maintenance and repairs, upgrades and more. Renters are able to keep home maintenance out of their budgets, and out of their weekend to-do lists. For Millennials with active lifestyles, having fewer things to do around the house can have a vast upside.

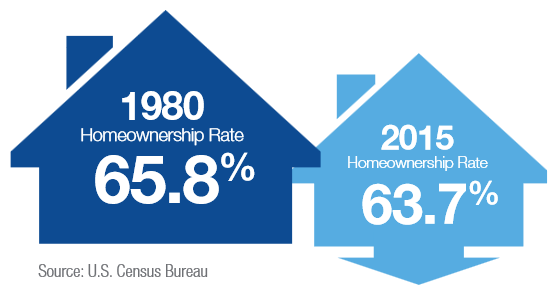

Changing Homeownership Rates

The rate of homeownership has decreased in the United States since the Baby Boomer generation was in its prime. Millennials and their preference to rent will have a large impact on housing demand since they will account for most newly formed households in the coming decade. Given Millennials’ characteristics and preferences, the trend of renting is expected to accelerate.

- 1 Joint Center for Housing Studies at Harvard University. State of the Nation’s Housing 2013.

- 2 PwC. Millennials at work: Reshaping the workplace. 2011.

- 3 Huffington Post. It’s an Exceptionally Bad Time to be a Recent College Grad. January 25, 2014.

- 4 Federal Reserve Bank of New York. Current Issues in Finance and Economics. Volume 20. Number 1. 2014.

- 5 Nielsen. Millennials: Breaking the Myths. 2014.

- 6 U.S. Census Bureau. Millennials Outnumber Baby Boomers and Are Far More Diverse, Census Bureau Reports. June 25, 2015.

- 7 Clark University Poll. 2014.

Disclosure

The views expressed herein are subject to change based upon economic, real estate and other market conditions. These views should not be relied upon for investment advice. Any forward-looking statements are based on information currently available to us and are subject to a number of known and unknown risks, uncertainties and factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

Important Risk Factors to Consider

Some of the risks related to investing in commercial real estate include, but are not limited to: market risks such as local property supply and demand conditions; tenants’ inability to pay rent; tenant turnover; inflation and other increases in operating costs; adverse changes in laws and regulations; relative illiquidity of real estate investments; changing market demographics; acts of God such as earthquakes, floods or other uninsured losses; interest rate fluctuations; and availability of financing. Some of the risks specifically related to investing in a non-traded real estate investment trust (or “REIT”) include, but are not limited to:

- The board of directors, rather than the trading market, determines the offering price of shares; there is limited liquidity because shares are not bought and sold on an exchange; repurchase programs may be modified or terminated; a typical time horizon for an exit strategy may be longer than five years; and there is no guarantee that a liquidity event will occur.

- Distributions cannot be guaranteed and may be paid from sources other than cash flow from operations, including borrowings and net offering proceeds. Payments of distributions from sources other than cash flow from operations may reduce the amount of capital a REIT ultimately invests in real estate assets and a stockholder’s overall return may be reduced.

- Failure to qualify as a REIT and thus being required to pay federal, state and local taxes, which may reduce the amount of cash available for distributions.

- Principal and interest payments on borrowings will reduce the funds available for other purposes, including distributions to stockholders. In addition, rates on loans can adjust to higher levels, and there is a potential for default on loans.

- Conflicts of interest with, and payments of significant fees to, a business manager, real estate manager or other affiliates.

- Tax implications are different for each stockholder. Stockholders should consult a tax advisor.

Publication Date: 12.14.2015