Over the long term, real estate investment performance is driven by cash flow and growth in net operating income (NOI). Through the power of NOI, owners of commercial real estate have the potential to increase a property's value year after year.

NOI is income generated by a property after expenses. The capitalization rate (cap rate), the percent of return expected if a property was purchased for all cash (unleveraged), is a common calculation used to estimate an investor’s potential return. Divide NOI by the purchase price to get the cap rate. For example, if a property produces $800,000 dollars of NOI annually, and you paid $8 million for the property, the cap rate would be 10 percent.

There has been a compression in cap rates over the past three to four years, as the value of real estate has increased. Take that same property that’s producing $800,000 of NOI, and sell it for $16 million instead of the original $8 million, and the cap rate would be 5 percent. This inverse relationship shows that as the real estate market gets stronger, cap rates decrease as property values increase.

Overall, the multifamily sector has posted the strongest long-term return performance among all commercial real estate sectors.1 Apartments, for example, exhibit the lowest capital requirements, which results in a higher dividend payout ratio.2 Apartment tenant turnover is more frequent than commercial tenants, so it is easier to re-lease apartment units than it is to re-tenant an office building or warehouse facility. In addition, multifamily’s shorter lease terms allow for more frequent increases in rent, which directly supports NOI growth over time.

Properties with potentially increasing annual revenue may be better positioned to improve NOI and market value. And according to Marcus & Millichap’s Premium Yield Index3, apartments in secondary markets currently are providing the highest yields (yield is the dividend you receive per share divided by the stock’s price per share.)

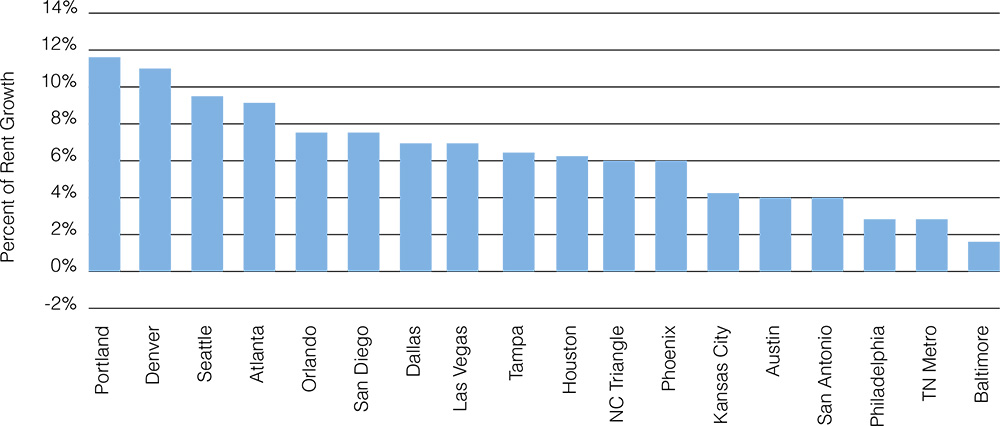

Rents are Increasing

Increasing rents are a cornerstone component of NOI growth. Short-term leases allow owners of multifamily properties to regularly raise rents to align with current market conditions. As an example, asking rents for multifamily grew by 0.6 percent in the first quarter of 2015. Over the previous four quarters, asking rent growth rose 3.3 percent. For perspective, in 2014, asking rents grew by 3.5 percent, its strongest showing since the apartment sector started recovering in early 2010.

Marketwide, average effective rents jumped 12.1 percent in the 12-month span ending in the second quarter 2015 to $1,260 per month. Over the same time period last year, effective rents rose 9.6 percent.3

With the multifamily vacancy rate hovering at or around 4-to-5 percent, the market is relatively tight, which allows landlords to continue to increase rent in excess of inflation. Other ways to raise revenue besides increasing the rent include application fees, pet deposits, pet rents, parking garage rental, washer and dryer fees, and more.

Active Property Management to Cut Costs

Active property management is an equally important strategy to decrease expenses and increase cash flow. Some of the areas management can rein in expenses are repairs and maintenance, utilities, insurance, personnel, property taxes, equipment and office supplies. In addition, negotiating fees, keeping an eye on contract services, and minimizing turnover costs serve to positively impact a property’s financial return.

Every tenant that renews a lease with an increase in rent contributes to NOI growth. Property owners and managers have many strategies they can employ to increase tenant retention. Examples of amenities that may keep residents loyal and interested in renewing their lease are minor capital improvements such as upgrading appliances and lighting, adding amenities such as movie nights and free wi-fi, and even giving tenants the option to rent month-to-month, to name a few.

The continuing strength of apartment demand in 2015 creates positive NOI growth potential. This is particularly due to Millennials, the children of the baby boomers. Around 80 million strong, they remain a huge untapped reservoir of demand for apartments. Most of them are in their 20s, an age where they’re looking to establish their own households.

As a result, high quality, well-located multifamily real estate assets are expected to continue to see growth over the foreseeable future, as owners focus on maximizing value at the property level through growing revenue and decreasing expenses.

An investment in commercial real estate can provide portfolio diversification and the potential for capital appreciation. Nonlisted REITs specifically are not priced by the equity markets, which also may help improve long-term investment performance. However, nonlisted REITs are not liquid investments and are appropriate for investors with longer time horizons and who do not need liquidity over the life of the investment.

Year-Over-Year Multifamily Rent Growth – As of April, 2015

Source: Yardi Matrix. Data provided by Pierce-Eislen. Matrix Monthly, April 2015

Sources

1TIAA-CREF Asset Management, U.S. Commercial Real Estate Outlook, March 2015.

2BlackRock Special Commentary: Long-Term Income Opportunities in U.S. Real Estate, June 2013.

3National Real Estate Investor, May 19, 2015.

4Apartment Research Market Report, Marcus & Millichap, Third Quarter 2015.

Disclosure

The views expressed herein are subject to change based upon economic, real estate and other market conditions. These views should not be relied upon for investment advice. Any forward-looking statements are based on information currently available to us and are subject to a number of known and unknown risks, uncertainties and factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

Important Risk Factors to Consider

Some of the risks related to investing in commercial real estate include, but are not limited to: market risks such as local property supply and demand conditions; tenants’ inability to pay rent; tenant turnover; inflation and other increases in operating costs; adverse changes in laws and regulations; relative illiquidity of real estate investments; changing market demographics; acts of God such as earthquakes, floods or other uninsured losses; interest rate fluctuations; and availability of financing.

Some of the risks specifically related to investing in a non-traded real estate investment trust (or “REIT”) include, but are not limited to:

- The board of directors, rather than the trading market, determines the offering price of shares; there is limited liquidity because shares are not bought and sold on an exchange; repurchase programs may be modified or terminated; a typical time horizon for an exit strategy may be longer than five years; and there is no guarantee that a liquidity event will occur.

- Distributions cannot be guaranteed and may be paid from sources other than cash flow from operations, including borrowings and net offering proceeds. Payments of distributions from sources other than cash flow from operations may reduce the amount of capital a REIT ultimately invests in real estate assets and a stockholder’s overall return may be reduced.

- Failure to qualify as a REIT and thus being required to pay federal, state and local taxes, which may reduce the amount of cash available for distributions.

- Principal and interest payments on borrowings will reduce the funds available for other purposes, including distributions to stockholders. In addition, rates on loans can adjust to higher levels, and there is a potential for default on loans.

- Conflicts of interest with, and payments of significant fees to, a business manager, real estate manager or other affiliates.

- Tax implications are different for each stockholder. Stockholders should consult a tax advisor.

Publication Date: 5.20.16