Investors are drawn to nonlisted real estate investment trusts (REITs) because they offer the opportunity for current distributions and capital appreciation. Many investors are willing to forgo liquidity for the opportunity for higher income potential over the long-term.

Nonlisted REITs allow individual investors to indirectly own income-producing properties through shares of the REIT. The assets are typically professionally managed with a focus on growing net operating income (NOI) in order to create value for its stockholders.

NOI is income generated by a property after expenses. There are two primary ways to grow NOI – decrease expenses or increase rents or other rental income.

In the attempt to grow NOI, a seasoned asset management team is key. An experienced team will work to implement efficiencies to minimize a property’s operating costs and increase rental rates as leases expire.

Rents are Expected to Continue to Increase

Rental income is a cornerstone component of NOI and it is the responsibility of the management team to adjust rents on a regular basis to align with current market conditions.

The major economic drivers that support commercial real estate growth remain positive. Consumer conditions should continue to improve, business investments are expected to pick up, and job growth continues to expand. Overall, demand is expected to remain strong while vacancy should tighten.1

Effective rent, which is the asking rent net of concessions such as free rent, across commercial property sectors is expected to continue to increase. Additional rental income contributes to NOI growth, which typically increases the value of the property.

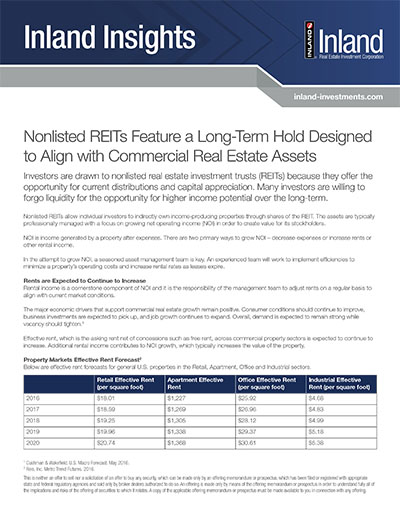

Property Markets Effective Rent Forecast2

Below are effective rent forecasts for general U.S. properties in the Retail, Apartment, Office and Industrial sectors.

| Retail Effective Rent (per square foot) |

Apartment Effective Rent | Office Effective Rent (per square foot) |

Industrial Effective Rent (per square foot) |

|

|---|---|---|---|---|

| 2016 | $18.01 | $1,227 | $25.92 | $4.68 |

| 2017 | $18.59 | $1,269 | $26.96 | $4.83 |

| 2018 | $19.25 | $1,305 | $28.12 | $4.99 |

| 2019 | $19.96 | $1,338 | $29.37 | $5.18 |

| 2020 | $20.74 | $1,368 | $30.61 | $5.38 |

- 1 Cushman & Wakefield. U.S. Macro Forecast. May 2016.

- 2 Reis, Inc. Metro Trend Futures. 2016.

As shown in the Property Markets Effective Rent Forecast chart, the retail sector is expected to experience a positive 2.7 percent change in effective rent in 2016, up from an effective per square foot rent of $17.54 at year-end 2015, rising to an expected 3.9 percent increase in 2020 from 2019. Positive 3.7 percent, 3.8 percent and 2.9 percent changes in the multifamily apartment, office and industrial sectors, respectively, are also expected in 2016.2

Three Phases of a Nonlisted REIT

The term of a nonlisted REIT is often five to seven years. During the three distinct phases of a nonlisted REIT discussed below, the real estate portfolio is given time to mature and to generate NOI.

Phase 1: Capital Raise – As capital is raised, the company focuses on acquiring and managing a portfolio of assets consistent with its investment strategy.

Phase 2: Portfolio Management – Once capital raise ends and the offering is closed to new investors, the company continues to manage the portfolio and increase NOI though active property management and property expense reduction, and oversees distribution payouts to investors, which are not guaranteed.

Phase 3: Exit Strategy – During this phase, the company determines an optimal time for a liquidity event and evaluates the option to sell, merge or list its shares on a public exchange. Proceeds (return of capital + distributions + potential profits from capital appreciation) are distributed to investors. However, there is no guarantee that a liquidity event will occur or that distributions will be paid.

Nonlisted REITs are illiquid investment vehicles with limited redemption opportunities. The long-term hold period aligns with the required time needed for the commercial real estate assets to grow and create value for stockholders.

Disclosure

The views expressed herein are subject to change based upon economic, real estate and other market conditions. These views should not be relied upon for investment advice. Any forward-looking statements are based on information currently available to us and are subject to a number of known and unknown risks, uncertainties and factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

Important Risk Factors to Consider

Some of the risks related to investing in commercial real estate include, but are not limited to: market risks such as local property supply and demand conditions; tenants’ inability to pay rent; tenant turnover; inflation and other increases in operating costs; adverse changes in laws and regulations; relative illiquidity of real estate investments; changing market demographics; acts of God such as earthquakes, floods or other uninsured losses; interest rate fluctuations; and availability of financing. Some of the risks specifically related to investing in a non-traded real estate investment trust (or “REIT”) include, but are not limited to:

- The board of directors, rather than the trading market, determines the offering price of shares; there is limited liquidity because shares are not bought and sold on an exchange; repurchase programs may be modified or terminated; a typical time horizon for an exit strategy may be longer than five years; and there is no guarantee that a liquidity event will occur.

- Distributions cannot be guaranteed and may be paid from sources other than cash flow from operations, including borrowings and net offering proceeds. Payments of distributions using offering or financing proceeds will reduce the amount of capital a REIT ultimately invests in real estate assets and a stockholder’s overall return may be reduced.

- Failure to qualify as a REIT and thus being required to pay federal, state and local taxes, which may reduce the amount of cash available for distributions.

- Principal and interest payments on borrowings will reduce the funds available for other purposes, including distributions to stockholders. In addition, rates on loans can adjust to higher levels, and there is a potential for default on loans.

- Conflicts of interest with, and payments of significant fees to, a business manager, real estate manager or other affiliates.

- Tax implications are different for each stockholder. Stockholders should consult a tax advisor.

Publication Date: 8.5.16