As a result of increases in federal tax rates, tax advantaged strategies are more critical than ever to protect stockholders’ investments. For Real Estate Investment Trust (REIT) stockholders in particular, there is a growing need for tax deferral and reduction.

REIT dividends are subject to a top income tax rate of 39.6%, in comparison to other corporate dividends that are subject to a top income tax rate of 20%1. Tax rate increases at the individual level negatively affect REIT dividends, which are subject potentially to three separate levels of taxation. Investors in some states could see a combined tax rate on their REIT dividends of over 50%. The three levels of taxation on REIT dividends are outlined below.

| Federal Tax Rate: | Top marginal tax rate increased from 35% to 39.6%. REIT dividends generally are taxed at your ordinary rate up to 39.6%. |

| Medicare Tax Rate: | A 3.8% surtax on investment income for taxpayers with taxable income exceeding $250,000 ($200,000 for single filers). |

| State Tax Rate: | Average 5.63%2 |

Potentially defer all three levels of taxation, and reduce the tax burden on REIT dividends

Through the valuation analysis known as Cost Segregation, Inland REITs are able to provide potential deferral and reduction of the 39.6% maximum federal income tax rate on their distributions. On an asset-by-asset basis, cost segregation should increase depreciation deductions for the REIT after a real estate asset is acquired. As a result, a REIT’s taxable dividends should be reduced to the extent the REIT otherwise would have had current or accumulated taxable earnings and profits. Accordingly, a REIT’s stockholders should be able to defer paying taxes to a later period, and ultimately should be able to pay taxes at a reduced rate under most circumstances.

Cost Segregation: What is it?

Cost Segregation is an Internal Revenue Service-approved valuation analysis of the different components of a real estate asset that has been used by public and private companies for over 50 years. The premise behind a Cost Segregation analysis is that some real estate components have a shorter useful life than the bricks and mortar of a building, and are depreciated over a shorter time. A Cost Segregation strategy aims to use that depreciation to offset the taxable income from the corporate REIT entity. This could result in the REIT taking a larger depreciation expense for tax purposes sooner in the life of the asset, as compared to depreciation expense without the benefit of Cost Segregation.

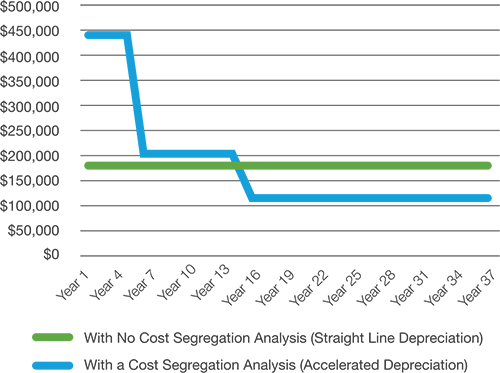

Cost segregation generally benefits investors that are stockholders at the time the REIT acquires the assets because the depreciation deductions from an asset are greater in the earlier years after acquisition of the asset. In addition, a greater percentage of distributions during these earlier years likely will be characterized as a return of capital, reducing the stockholder’s tax basis in the REIT stock (or capital gain if the stockholder’s tax basis in the REIT stock is reduced to zero). This reduction in a stockholder’s tax basis in the REIT stock may increase the amount of gain recognized by the stockholder upon sale of the REIT stock.

Hypothetical Example – Depreciation Expense

Pay Later. Pay Less.

The use of Cost Segregation valuation analysis may provide investors with two main benefits.

Pay later. Potentially defer paying taxes to a later period.

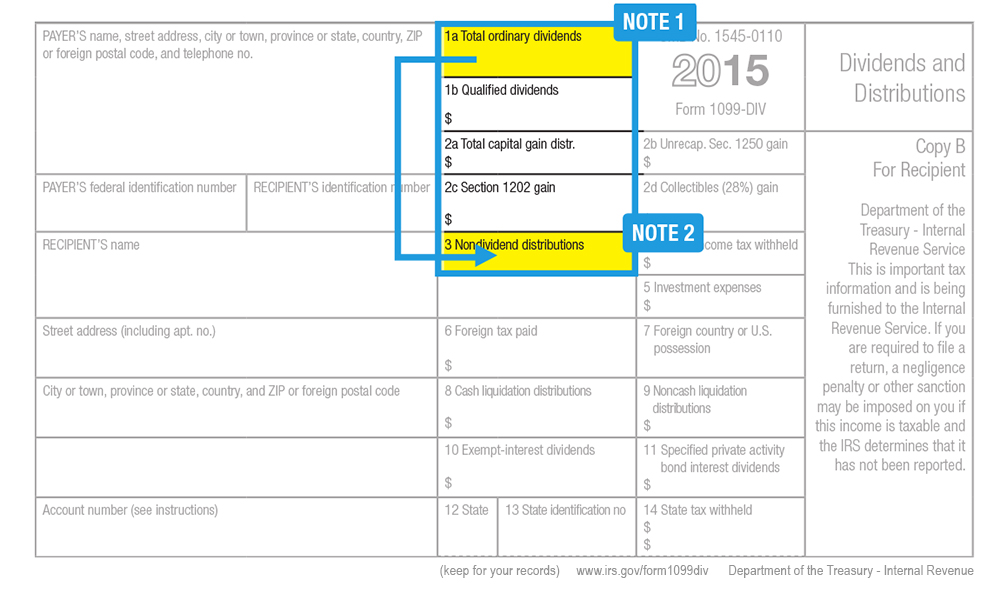

When an entity implements a Cost Segregation strategy, the entity is using more depreciation allowances on the front end, which may result in more depreciation allowance being passed down to the stockholder. An investor will be able to see this on their 1099.

Pay less. Pay taxes at a reduced rate under most circumstances.

Eventually, stockholders will have to pay taxes on the portion of income that shows up in Box 3 of the 1099, which is a non-dividend distribution and taxed at long term capital gains, that typically are taxed at lower rates than ordinary income.

Form 1099-DIV

NOTE 1: Ordinary REIT dividends are taxed at the maximum ordinary federal income tax rate. The use of Cost Segregation may allow investors to push out ordinary tax liability into the future and may re-characterize ordinary income into long-term capital gains.

NOTE 2: A stockholder’s distribution that is determined to be a non-dividend distribution for federal income tax purposes is not taxed until that stockholder’s tax basis in the REIT stock is fully recovered. Once the tax basis of the stock is reduced to zero, provided the applicable holding period is met, any non-dividend distribution would be reported as long-term capital gain and taxed at the applicable federal capital gain tax rates. In the event the stockholder sells his or her stock for a price in excess of the stock tax basis, the excess of the sale price over his or her tax basis (the amount paid for his or her stock reduced by any non-dividend distributions received) would be reported as capital gain and provided the applicable holding period is met, taxed at only a 20% rate for federal income tax purposes.

Definitions:

Any distributions paid to stockholders out of a company’s earnings and profits are considered ordinary dividends (unless they are “qualified dividends” as defined below), and will be taxed as ordinary income.

A qualified dividend is a type of dividend to which capital gains tax rates apply. These tax rates are usually lower than regular income tax rates. In order to qualify: 1.) the dividend must have been paid by an American company or qualifying foreign company; 2.) the dividends are not listed with the IRS as dividends that do not qualify; and 3.) the required dividend holding period has been met.

A non-dividend distribution is a type of distribution that is paid to stockholders of a corporation not as a result of earnings, but as a return of capital. Stockholders who receive non-dividend distributions must reduce the basis in their stock accordingly. Upon the sale of the stock, the resultant gain or loss will be calculated from the adjusted basis. When a stock is sold for a profit, the portion of the proceeds over and above the purchase value (or cost basis) is known as capital gains.

There is no assurance that Cost Segregation will reduce the tax rate. There is no assurance that the results of a Cost Segregation study will cause the amount of earnings and profits to be reduced, which would result in a portion of the distribution being treated as a return of capital, and therefore would be taxed at a lower rate than ordinary income. Tax deferral occurs where distributions are made in excess of taxable earnings and profits.

Sources

1 IRS. Publication 17. http://www.irs.gov/publications/p17/ar01.html

2 Average of personal state income tax rates for 2015 (all 50 states and Washington, D.C.) for married filers with taxable income over $464,850. Source – “Tax Rates by State” www.tax-rates.org The Federal & State Tax Information Portal

Important Risk Factors to Consider

Some of the risks related to investing in commercial real estate include, but are not limited to: market risks such as local property supply and demand conditions; tenants’ inability to pay rent; tenant turnover; inflation and other increases in operating costs; adverse changes in laws and regulations; relative illiquidity of real estate investments; changing market demographics; acts of God such as earthquakes, floods or other uninsured losses; interest rate fluctuations; and availability of financing.

Cost Segregation may be used by both traded and non-traded REITs. However, the specific discussions herein, and the risk factors below, relate to an investment in a nontraded REIT. Some additional risks related to investing in a non-traded REIT include, but are not limited to:

- The board of directors, rather than the trading market, determines the offering price of shares; there is limited liquidity because shares are not bought and sold on an exchange; repurchase programs may be modified or terminated; a typical time horizon for an exit strategy is longer than five years; and there is no guarantee that a liquidity event will occur.

- Distributions cannot be guaranteed and may be paid from sources other than cash flow from operations, including borrowings and net offering proceeds. Payments of distributions from sources other than cash flow from operations may reduce the amount of capital a REIT ultimately invests in real estate assets and a stockholder’s overall return may be reduced.

- Failure to qualify as a REIT and thus being required to pay federal, state and local taxes, which may reduce the amount of cash available for distributions.

- Principal and interest payments on borrowings will reduce the funds available for other purposes, including distributions to stockholders. In addition, rates on loans can adjust to higher levels, and there is a potential for default on loans.

- Conflicts of interest with, and payments of significant fees to, a business manager, real estate manager or other affiliates.

- Tax implications are different for each stockholder. Stockholders should consult a tax advisor.

Publication Date: 09.10.2013