The U.S. apartment sector is healthy and is expected to remain that way for the next several years, as demand from younger renters and renters-by-choice continues to grow.

“We’ve never seen this kind of demand before,” says JoAnn McGuinness, COO of Inland Residential Properties Trust. “There’s a larger pool of people choosing to rent today. The population is growing, Millennials are establishing households, and a lot of people are choosing to rent instead of buying a home. We don’t see that changing in the next five to seven years.”

Achieving “Magic” Occupancy Rate

Multifamily occupancy hit 94.9 percent in the second quarter of 2015, which is up from 94.6 percent a year earlier. The nationwide occupancy rate hasn’t been this strong since first quarter 2001.1

“In the apartment industry, 95 percent occupancy is a magic number,” says Rod Curtis, senior vice president, research and product development for Inland Real Estate Investment Corp. “At that level of occupancy, there aren’t a lot of choices for renters, and landlords have a significant amount of pricing power to raise rents.”

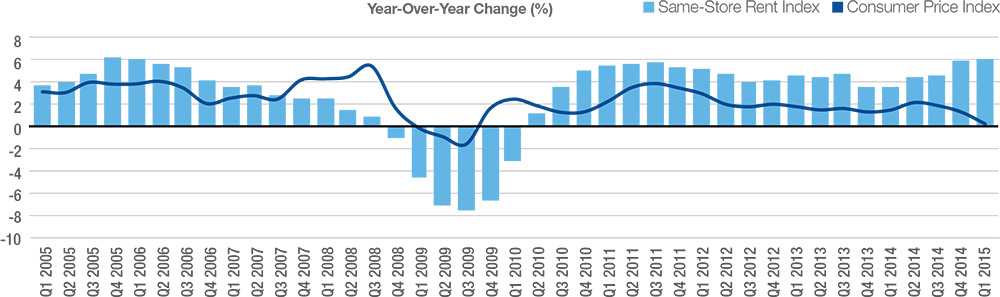

Rents for new leases rose 5.2 percent year-over-year, which is a 15-year high. Rents for renewal leases weren’t too far behind at 4.3 percent year over year.1 The average rent per unit increased by 5.9 percent, year-over-year, in the first quarter of 2015 across the major apartment markets—its strongest rate of growth since 2006.2

Curtis points out that the largest markets in the nation have enjoyed significant rent growth during the past couple of years. “Over the next few years, we’re going to see the same thing happen in smaller markets,” he predicts. “There’s still room for growth.”

National Rent Growth at a Nine-Year High

Source: CBRE Econometric Advisors, Q1 2015.

More Supply to Satisfy Demand

Curtis contends that there is pent-up demand for apartment rentals. “As the economy continues to improve, a lot of people who are still living with their parents or sharing space with roommates will establish their own households,” he points out.

During the recession, apartment development fell to historic lows. Construction loans were difficult, if not impossible to obtain. However, as the debt markets have thawed and apartment occupancy has surged, apartment construction has increased. In fact, it has increased so much that some people have tossed around the word “oversupply”. However, experts contend that there’s no reason to be worried.

“If you look at the construction numbers by themselves, they are slightly concerning,” says Rahul Sehgal, chief investment officer at Inland Private Capital Corp. “But when you factor in the population increase and the shift in the way people think about renting versus homeownership, the level of new development isn’t a problem.”

The National Multi Housing Council (NMHC) revealed completions of 5+ unit multifamily rental homes of more than 255,000 in 2014—close to the level reached in the 1999 to 2000 period.3

Yet those levels aren’t enough to satisfy demand. “To meet existing demand for apartments, the market requires at least 300,000-400,000 new apartments to be built every year,” the association wrote in their apartment supply shortage fact sheet.4 Even with the increase in production, we have not reached that threshold.

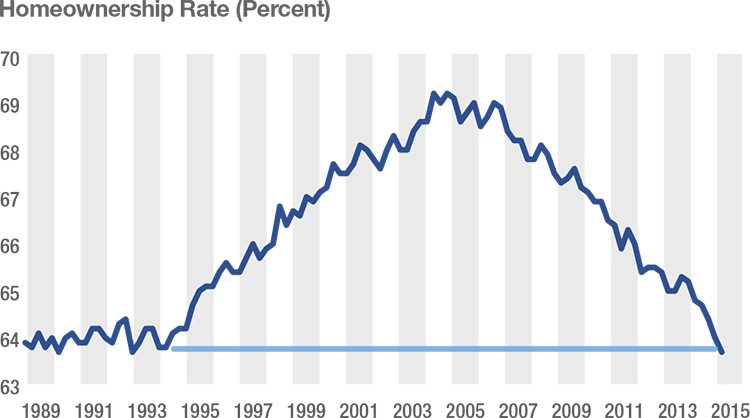

The National Homeownership Rate Has Fallen Back to 1993 Levels…

Source: JCHS tabulations of US Census Bureau, Housing Vacancy Surveys

Falling Homeownership Rate

The U.S. homeownership rate continued to fall in 2014, marking its lowest levels in 20 years, affecting most segments of the population, according to the Joint Center for Housing Studies at Harvard University. The national rate stood at 63.7 percent in the first quarter of 2015—its lowest reading since 1993.5

With higher debt levels, many younger adults find themselves in a situation that is not conducive to homeownership.

“Over the span of just 10 years, the share of renters aged 25-34 with cost burdens increased from 40 percent to 46 percent. During roughly the same period, the share of renters aged 25-34 with student loan debt jumped from 30 percent in 2004 to 41 percent in 2013, with the average amount of debt up 50 percent, to $30,700,” the Joint Center for Housing Studies wrote in its annual report The State of the Nation’s Housing 2015.5

In fact, a recent survey by the Federal Reserve Bank of New York found 64 percent of current renters reported that obtaining a mortgage would be somewhat or very difficult.6

The flip side of falling demand for owner-occupied housing has been exceptionally strong demand for rental units. Census Bureau data show that 2014 marked the tenth consecutive year of robust renter household growth. This puts the 2010s on track to be the strongest decade for renter household growth in history. The average number of new renter households per year has increased significantly. Ten years ago, roughly 770,000 new renter households were formed every year. Four years ago, that average increased to 900,000. And last year, new renter households averaged just north of a million.7

But it’s not just a lack of money that’s keeping people in apartments. They want to be there.

“There’s been a drastic shift in mindset about homeownership, and that shift is contributing to apartment demand,” Sehgal says. “People like the flexibility of apartments in case they have to move for a job, the freedom from typical expenses related to owning a home, as well as the vast amenities many apartment communities provide.”

Sources

1 Multifamily Executive. MPF Says Rent Growth Hits 15-Year High in Mid-2015. July 8, 2015.2 CBRE U.S. Multifamily Marketview Q1 2015.

3 National Multifamily Housing Council. Quick Facts: New Construction.

4 National Multifamily Housing Council. Apartment Supply Shortage Fact Sheet.

5 Joint Center for Housing Studies at Harvard University. The State of the Nation’s Housing 2015.

6 Federal Reserve Bank of New York. Survey of Consumer Expectations 2015 Housing Survey.

7 National Multifamily Housing Council. Renter Household Growth Stems from a Diversity of New Residents. June 25, 2015.

Disclosure

The views expressed herein are subject to change based upon economic, real estate and other market conditions. These views should not be relied upon for investment advice. Any forward-looking statements are based on information currently available to us and are subject to a number of known and unknown risks, uncertainties and factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

Important Risk Factors to Consider

Some of the risks related to investing in commercial real estate include, but are not limited to: market risks such as local property supply and demand conditions; tenants’ inability to pay rent; tenant turnover; inflation and other increases in operating costs; adverse changes in laws and regulations; relative illiquidity of real estate investments; changing market demographics; acts of God such as earthquakes, floods or other uninsured losses; interest rate fluctuations; and availability of financing.

Some of the risks specifically related to investing in a non-traded real estate investment trust (or “REIT”) include, but are not limited to:

- The board of directors, rather than the trading market, determines the offering price of shares; there is limited liquidity because shares are not bought and sold on an exchange; repurchase programs may be modified or terminated; a typical time horizon for an exit strategy is longer than five years; and there is no guarantee that a liquidity event will occur.

- Distributions cannot be guaranteed and may be paid from sources other than cash flow from operations, including borrowings and net offering proceeds. Payments of distributions from sources other than cash flow from operations may reduce the amount of capital a REIT ultimately invests in real estate assets and a stockholder’s overall return may be reduced.

- Failure to qualify as a REIT and thus being required to pay federal, state and local taxes, which may reduce the amount of cash available for distributions.

- Principal and interest payments on borrowings will reduce the funds available for other purposes, including distributions to stockholders. In addition, rates on loans can adjust to higher levels, and there is a potential for default on loans.

- Conflicts of interest with, and payments of significant fees to, a business manager, real estate manager or other affiliates.

- Tax implications are different for each stockholder. Stockholders should consult a tax advisor.

Publication Date:8.10.15