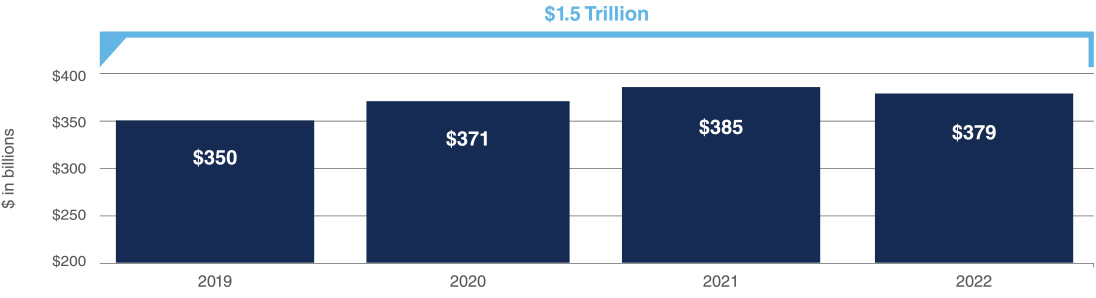

More than $1.5 trillion in mortgage loans mature over the next four years, creating an opportunity for commercial mortgage real estate investment trusts (REITs) and other private real estate direct lenders that finance income-producing properties like apartments, hotels, offices, industrial facilities and retail centers.

Many large lenders of the past (commercial banks, thrifts and insurance companies) no longer are able to compete in this refinancing environment. Banks and other traditional commercial real estate lenders have decreased debt originations in large part due to an increasingly restrictive regulatory environment, which is expected to continue if not intensify. Commercial mortgage-backed securities (CMBS) lenders also face a number of headwinds amid regulatory changes, such as the retention rules set forth in the Dodd-Frank Act and higher capital charges on certain securities held by investment banks.

As a result, there is a limited lending supply and increased demand for financing and refinancing. This is creating a void that can be filled by alternative providers such as REITs and private investment funds, which are not subject to many of the regulatory requirements of larger banks, insurance companies and other financial institutions.

In the continued search for yield, investors may want to consider mortgage REITs for income potential, which compares favorably to other alternatives. Given that some mortgage REITs focus on shortterm floating-rate loans, which can keep pace with rate increases, the appeal of this asset class becomes even more desirable in a rising interest rate market. In a floating-rate loan structure, however, there is the chance mortgage holders will not be able to keep up with increased payments.

Some of the risks related to investing in commercial real estate – the properties underlying the debt – include local property supply and demand conditions, tenants’ inability to pay rent and increases in operating costs, to name a few.

$1.5 Trillion of Mortgages Maturing Over Next Five Years

Source: Trepp - Based on Federal Reserve Flow of Funds Data.

There is no guarantee that market conditions will continue or be profitable.

Commercial Mortgage REIT Business Model

The general objective of a commercial mortgage REIT is to earn money on the interest rate or lending rate they charge over the course of a loan. Investments may include commercial mortgages as well as both rated and unrated CMBS, mezzanine loans, and subordinated securities. These investments may be lower credit quality, and may have a higher risk of default and loss than investment grade rated assets.

Commercial mortgage REIT portfolio managers typically evaluate potential investments to determine if they meet the investment criteria and objectives of the REIT. Commercial properties underlying the debt are often inspected and several factors are considered, including macroeconomic conditions, the amount of existing debt, the opportunity for capital appreciation and expected levels of rental and occupancy rates. In addition, risk management control systems are put in place to monitor cash flow and a comprehensive analysis of the loan portfolio regularly takes place.

Historical Returns and Performance

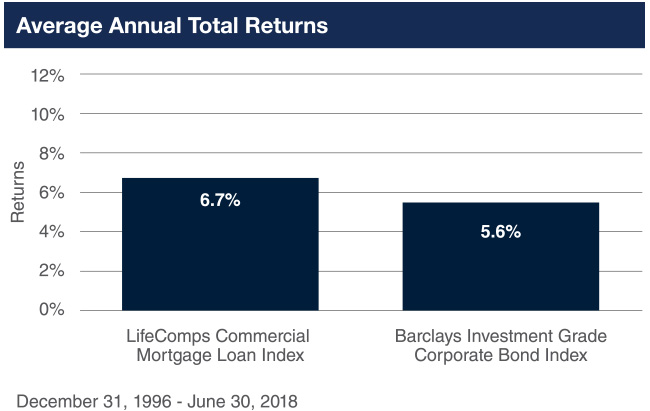

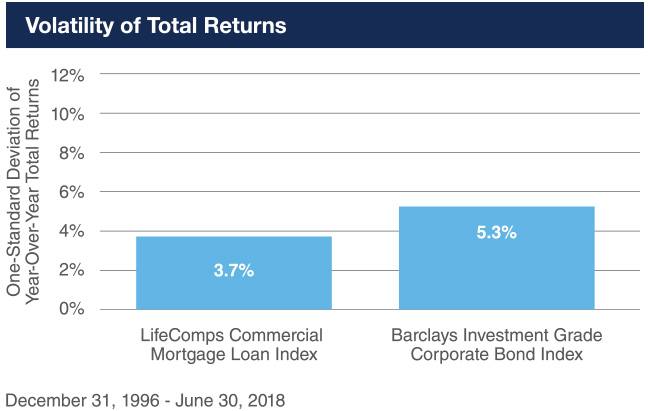

For more than two decades commercial real estate mortgages have delivered a higher total return with less volatility than investment grade corporate bonds, as measured by LifeComps Commercial Mortgage Loan Index and Barclays Investment Grade Corporate Bond Index.

Investors looking for income solutions may want to consider mortgage REITs as part of a diversified portfolio.

Commercial Real Estate Mortgage Relative Performance

The chart above is for illustrative purposes to compare the historical returns of commercial mortgages and investment grade corporate bonds, which share similar duration. Investment Grade Corporates are represented by the Barclays Investment Grade Corporate Bond Index, officially known as Bloomberg Barclays US Corporate Total Return Value Unhedged USD, which measures the U.S. dollar-denominated investment grade, fixed-rate, taxable corporate bond market. Corporate bonds may be subject to default and interest rate risk. CRE first mortgages are represented by the LifeComps Commercial Mortgage Loan Index which measures actual private commercial mortgage market loan cash flow and performance data collected quarterly from participating life insurance companies since 1996. Commercial mortgages may be subject to default risk. An investor cannot invest directly in an index, and index performance does not reflect the deduction of fees, expenses or taxes. The performance data shown represents past performance, which is not a guarantee of future results.

Sources: Bloomberg Barclays US Corporate Total Return Value Unhedged USD. LifeComps Commercial Mortgage Loan Index.

Return Calculations: Total return indicated is compound annual growth rate (CAGR) for Bloomberg Barclays US Corporate Total Return Value Unhedged USD. LifeComps Commercial Mortgage Loan Index is average annualized returns.

Commercial real estate (CRE) credit and securities investments are subject to the risks typically associated with CRE which include, but are not limited to: market risks such as local property supply and demand conditions; tenants’ inability to pay rent; tenant turnover; inflation and other increases in operating costs; adverse changes in laws and regulations; relative illiquidity of real estate investments; changing market demographics; acts of nature such as earthquakes, floods or other uninsured losses; interest rate fluctuations; and availability of financing.

Investing in common stock of InPoint Commercial Real Estate Income, Inc. (InPoint) involves a high degree of risk. You should purchase these securities only if you can afford the complete loss of your investment. You should carefully review the “Risk Factors” section of the prospectus for a more detailed discussion. Some of the more significant risks relating to an investment in InPoint’s shares include:

- We have a limited operating history, and there is no assurance that we will achieve our investment objectives.

- This is a “blind pool” offering. You will not have the opportunity to evaluate our future investments before we make them.

- Since there is no public trading market for shares of our common stock, repurchase of shares by us will likely be the only way to dispose of your shares. Our share repurchase plan will provide stockholders who have held their shares for at least one year with the opportunity to request that we repurchase their shares on a monthly basis, but we are not obligated to repurchase any shares and may choose to repurchase only some, or even none, of the shares that have been requested to be repurchased in any particular month at our discretion. In addition, repurchases will be subject to available liquidity and other significant restrictions. Further, our board of directors may modify, suspend or terminate our share repurchase plan if it deems such action to be in our best interest and the best interest of our stockholders. As a result, our shares should be considered as having only limited liquidity and at times may be illiquid.

- We cannot guarantee that we will make distributions, and if we do we may fund such distributions from sources other than cash flow from operations, including, without limitation, the sale of assets, borrowings, return of capital or offering proceeds, and we have no limits on the amounts we may pay from such sources.

- Following the NAV Pricing Date, the purchase and repurchase price for shares of our common stock are generally based on our prior month’s NAV (subject to material changes as described above) and are not based on any public trading market. The valuation of our investments is inherently subjective, and our NAV may not accurately reflect the actual price at which our investments could be liquidated on any given day.

- We have no employees and are dependent on the Advisor and the Sub-Advisor to conduct our operations. The Advisor and the Sub-Advisor will face conflicts of interest as a result of, among other things, the allocation of investment opportunities among us and Other Sound Point Accounts, the allocation of time of their investment professionals and the substantial fees that we will pay to the Advisor and that the Advisor will pay to the Sub-Advisor.

- This is a “best efforts” offering. If we are not able to raise a substantial amount of capital on an ongoing basis, our ability to achieve our investment objectives could be adversely affected.

- If we fail to maintain our qualification as a REIT and no relief provisions apply, we will have to pay corporate income tax on our taxable income (which will be determined without regard to the dividends-paid deduction available to REITs) and our NAV and cash available for distribution to our stockholders could materially decrease.

As with any investment, there are certain risks associated with credit investing. Such risks include, but are not limited to:

- The risk of nonpayment of scheduled interest or principal payments on a credit investment, which may affect the overall return to the lender;

- Interest rate fluctuations, which will affect the amount of interest paid by a borrower in a floating-rate loan that adjusts to current market conditions;

- Default risk, which means that the loan may not be repaid by the borrower; and

- The risks typically associated with real estate assets, such as changes in national, regional and local economic conditions, local property supply and demand conditions, ability to collect rent from tenants, vacancies or ability to lease on favorable terms, increases in operating costs, including insurance premiums, utilities and real estate taxes, federal, state or local laws and regulations, changing market demographics, changes in availability and costs of financing and acts of nature, such as hurricanes, earthquakes, tornadoes or floods.

The Inland name and logo are registered trademarks being used under license. This material has been prepared by Inland Real Estate Investment Corporation (Inland Investments) and distributed by Inland Securities Corporation, member FINRA/SIPC, dealer manager for InPoint and placement agent for programs sponsored by Inland Investments and Inland Private Capital Corporation.

Publication Date: 8.15.2019