Manufactured housing communities (MHCs) and industrial real estate are unique property types that are experiencing current growth. The performance of the sectors justifies a closer look at these once overlooked real estate investment opportunities.

According to Green Street Advisors’ Green Street CPPI: Sector-Level Indexes, the property values of both MHCs and industrial rose more than any other sector in 2019. MHCs rose by 16 percent and industrial followed closely at a 13 percent increase.1

The market index value, which measures the value of a portfolio of holdings with specific market characteristics and often used as benchmarks to gauge the movement and performance of market segments, indicates MHCs and industrial real estate are seeing continued expansion.

| 2019 Sector Indexes | ||

|---|---|---|

| Market Index Value | Change in Commercial Property Values | |

| Multi-Family | ||

| Manufactured Home Park | 233.3 | 16% |

| Apartment | 152.2 | 6% |

| Student Housing | 154.9 | 3% |

| Industrial | 164.7 | 13% |

| Office | 116.8 | 3% |

| Retail | ||

| Strip Retail | 111.7 | 1% |

| Mall | 106.9 | -11% |

Data provided by Green Street Advisors Commercial Property Price Index. January 2020 Press Release.

Manufactured Housing Communities

Manufactured housing communities are the parks in which manufactured homes are installed. With tenants renting sites and responsible for individual housing costs and maintenance, MHC owners have relatively low overhead limited to capital needs such as roads, water and sewer infrastructure. Additionally, the potential for annual rental increases may generate an attractive and growing income.

With the increase in demand for cost-effective housing solutions, the MHC property type has exhibited growth over the last two decades and outperformed all other real estate classes.

- 22 million people live in manufactured homes2

- 62% of all MHC residents anticipate living in their homes for more than 10 years3

- Manufactured homes are competitively priced at an average of $49 per square foot vs $107 per square foot for traditional homes2

Industrial Real Estate

Industrial real estate is a type of commercial property that is used by companies to execute business and manufacturing operations. Industrial properties typically include factories, warehouses, and distribution centers. Owners of industrial real estate experience relatively low maintenance costs since most properties are large spaces used as storage for inventory or production areas for companies. Additionally, industrial tenants tend to sign longer leases which leads to lower turn-over and the potential for long-term stable cash flow.

Due to the success of e-commerce, its impact to supply chains, and the need for distribution centers closer to consumers, the demand for industrial real estate continues with 13.4 billion square feet of industrial space across the U.S.5

- 4.9% average industrial vacancy rate5

- 292 million square feet of industrial real estate constructed in 20195

- Net absorption* of 166 million square feet5

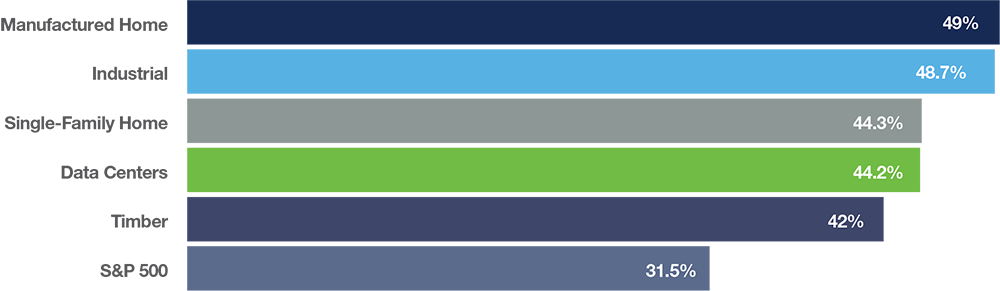

MHC & Industrial REITs Outperform S&P 500

In addition to MHCs and industrial real estate property values and market index leading in the private investment sector, both property types topped the publicly traded REITs (real estate investment trusts) sector in 2019. These top performing property types surpassed the S&P 500 by nearly 17 percent and 18 percent, respectively.

2019 REIT Sector Returns

Source: Nareit, S&P 500 historic data

Generally, REITs invest in real properties or mortgages/loans and often focus on particular property types such as apartments, hotels and retail. REITs have the potential to deliver competitive returns through stable dividend growth and long-term capital appreciation.

In its 2020 Real Estate Outlook, Fidelity states that the REIT market has grown more diversified over the last ten years. Traditional REIT segments are giving way to new and emerging categories6 including MHCs and industrial.

With their stable growth and long-term return potential, it's no wonder that unique properties types like manufactured housing communities and industrial real estate are dominating the marketplace in terms of value.

*According to JLL, Net absorption is the sum of square feet that became physically occupied, minus the sum of square feet that became physically vacant during a specific period.

Sources

1 Green Street Advisors. Press Release. Commercial Property Prices Up 2.5% in 2019. January 2020.

2Manufactured Housing Institute. 2018 Manufactured Housing Facts. Industry Overview. June 2018.

3MHInsider. Data Infographic on Manufactured Housing Industry Statistics and Trends. August 2019.

4Nareit. U.S. REITs End 2019 With Double-Digit Returns. January 2020.

5JLL. Industrial Outlook, United States, Q3 2019. Acquired January 2020.

6Fidelity. 2020 Outlook: Real Estate. December 2019.

Disclosure

This commentary is neither an offer to sell nor a solicitation of an offer to buy securities.

The views expressed herein are subject to change based upon economic, real estate and other market conditions. These views should not be relied upon for investment advice. Any forwardlooking statements are based on information currently available to us and are subject to a number of known and unknown risks, uncertainties and factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements.

Important Risk Factors to Consider

Investments in real estate assets are subject to varying degrees of risk and are relatively illiquid. Several factors may adversely affect the financial condition, operating results and value of real estate assets.

These factors include, but are not limited to:

- changes in national, regional and local economic conditions, such as inflation and interest rate fluctuations;

- local property supply and demand conditions;

- ability to collect rent from tenants;

- vacancies or ability to lease on favorable terms;

- increases in operating costs, including insurance premiums, utilities and real estate taxes;

- federal, state or local laws and regulations;

- changing market demographics;

- changes in availability and costs of financing; and

- acts of nature, such as hurricanes, earthquakes, tornadoes or floods.