As of December 31, 2022

The information contained in the Portfolio Overview reflects the performance of all 305 IPC programs offered to investors through December 31, 2022 by Inland Private Capital Corporation (IPC). Past performance is not indicative of future results. Investments in offerings sponsored by IPC involve certain risks including but not limited to tax risks, general real estate risks, risks relating to the financing on the applicable property (if any), risks relating to the ownership and management of the property, risks relating to private offerings and the lack of liquidity, and risks relating to the Delaware statutory trust structure or qualified opportunity fund structure, as applicable. In addition, IPC can give no assurance that it will be able to pay or maintain distributions, or that distributions will increase over time. IPC invests in a diversified portfolio of properties in terms of type of assets, locations of properties, and industries. Except as otherwise indicated herein, all data in the Portfolio Overview aggregates these properties for an overall snapshot of the portfolio. Full-Cycle Programs are those programs that no longer own any assets. However, in certain limited situations in which the subject property(ies) were in foreclosure, IPC has negotiated with the lenders and advanced funds to the investors to allow the investors to exchange their beneficial interest in the original program for a proportionate beneficial interest in a new program, in order to continue their Section 1031 exchanges and avoid potential capital gains and/or forgiveness of debt tax liabilities. Because such exchanges result in an investment continuation, the original programs are not considered full-cycle programs for these purposes. Weighted Average Annualized Rate of Return (ARR) For each full-cycle program, the ARR is calculated by dividing (a) the sum of (i) total cash flows distributed during the term of the investment program, plus (ii) any net sales proceeds distributed less the investors’ original capital, by (b) the investors’ original capital; with the result then further divided by (c) the investment period (in years) for that program. To determine the weighted average for all programs, the ARR for each program is multiplied by the capital invested in that program, divided by the total capital invested in all full-cycle programs since inception (2001). To determine the weighted average in each asset class, the ARR for each program within that asset class is multiplied by the capital invested in that program, divided by the total capital invested in all full-cycle programs within that asset class since inception (2001). An investment in an IPC-sponsored program is subject to various risks, including but not limited to: The Inland name and logo are registered trademarks being used under license. Inland refers to some or all of the entities that are part of The Inland Real Estate Group of Companies, Inc., one of the nation’s largest commercial real estate and finance groups, which is comprised of independent legal entities, some of which may be affiliates, share some common ownership or have been sponsored and managed by such entities or subsidiaries thereof. Inland has been creating, developing and supporting real estate-related companies for more than 50 years. This material has been distributed by Inland Securities Corporation, member FINRA/SIPC, dealer manager and placement agent for programs sponsored by Inland Real Estate Investment Corporation and Inland Private Capital Corporation, respectively.Approximately

$0.0B

Assets Under Management (AUM)

0.00%

Weighted Average Annualized Rate of Return on Full-Cycle Programs*

Results by Asset Class

Number of Properties

Cumulative Sales Price

Weighted Average ARR

Multifamily

24

$1,660,748,108

11.60%

Retail

60

$1,128,216,066

6.94%

Office

22

$473,700,165

4.00%

Self-Storage

3

$265,000,000

13.70%

Student Housing

3

$196,321,250

6.88%

Industrial

9

$148,370,041

5.56%

Healthcare

2

$62,725,000

11.40%

Assets Under Management by Sector

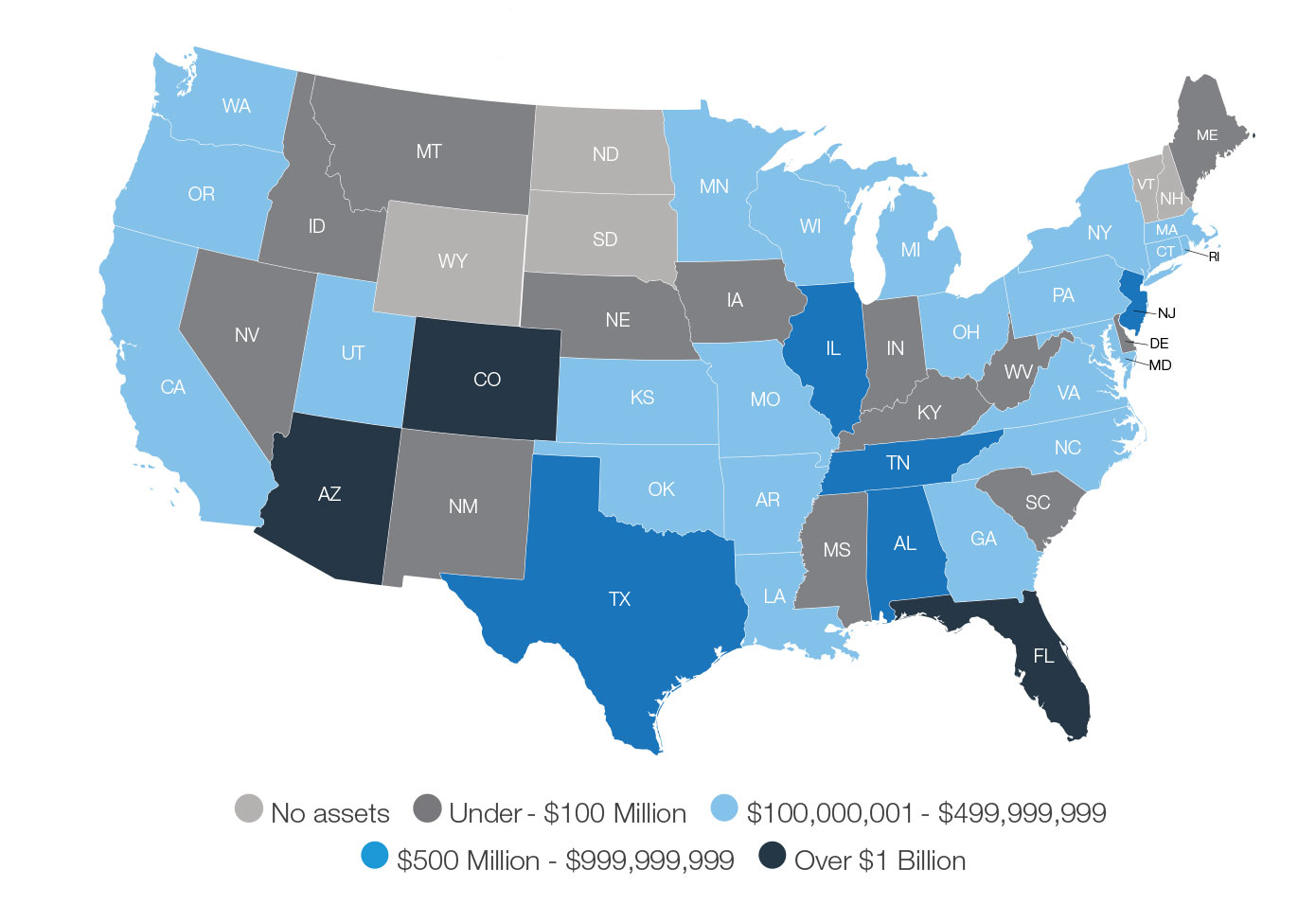

Assets Under Management by State

Track Record Since Inception (Through December 31, 2022)

305

Sponsored Programs

898

Properties Acquired

123

Completed Dispositions

More than

$3.9 Billion

in Full-Cycle Asset Dispositions

More than

$ 16.2 Billion

in Acquisitions

Important Disclosures

* Explanation of Terms & Calculations

Important Disclosures

Portfolio Overview

Inland Private Capital Corporation

This website is neither an offer to sell nor a solicitation of an offer to buy any security which can be made only by a prospectus or offering memorandum, which has been filed or registered with appropriate state and federal regulatory agencies, and sold only by broker dealers and registered investment advisors authorized to do so. All of the content on inland-investments.com is subject to terms and conditions available on Important Disclosures.

The Inland name and logo are registered trademarks being used under license. "Inland" refers to The Inland Real Estate Group of Companies, Inc. which is comprised of a group of independent legal entities some of which may be affiliates, share some common ownership or have been sponsored and managed by such entities or subsidiaries thereof including the Inland Real Estate Investment Corporation (Inland Investments) and Inland Securities Corporation. Inland Securities Corporation, member FINRA/SIPC, is dealer manager and placement agent for programs sponsored by Inland Investments and Inland Private Capital, respectively. For more information on Inland Securities Corporation, visit FINRA BrokerCheck.